In June 2016, the transforming Dutch NXP Semiconductors decided to sell its standard product business. The Zhongguancun Rongxin Financial and Information Industry Alliance's Jianguang Assets and Zhilu Capital defeated competitors and jointly invested US$2.75 billion from NXP Semiconductors. After acquiring this business, Nexperia was established on this basis, namely Nexperia Semiconductor.

Anshi Semiconductor is a rare high-quality asset, and it is in a leading position in the field of discrete devices, logic devices and PowerMOS. NXP Semiconductors 2015 annual operating income was 6.101 billion US dollars, and its standard product business operating income reached 1.241 billion US dollars, accounting for about 20.34%. NXP Semiconductors integrates design, manufacturing, packaging and testing, and is a typical IDM company. , Annual production and sales of nearly 100 billion components! From the global ranking of market segments, Nexperia semiconductor diodes and transistors ranked first, logic devices ranked second (behind Texas Instruments), ESD protection devices ranked second, small signal MOSFETs ranked second, and automotive power MOSFETs ranked second (Second only to Infineon Semiconductor).

The successful acquisition of such high-quality assets not only makes up for the shortcomings of local semiconductors in analog and power devices, but also creates value for the partners of the alliance investment institution! After the acquisition, through post-investment management, Nexperia's turnover in 2019 was close to 1.5 billion U.S. dollars, and it has achieved substantial growth. In addition, after Wingtech acquired most of Nexperia's shares, its profit margin has soared. In 2019 In China's A-share market, Wingtech Technology has soared all the way, and its market value quickly exceeded 100 billion.

The acquisition of Nexperia has achieved a real win-win situation and can be regarded as a model of capital operation!

Now, I will analyze another recent acquisition by Zhilu Capital.

On July 28, 2020, the global back-end packaging equipment supplier ASM PT (00522-HK) announced on the Hong Kong Stock Exchange that it has established a high-tech joint venture with a consortium led by Zhilu Capital, a core member of the Rongxin Industry Alliance. , The joint venture is controlled by Zhilu Capital and will focus on providing lead frames for memory, analog chips, microcontrollers and automotive chips.

According to the announcement, ASM will issue target shares to Zhilu Capital Co., Ltd. and related investors with a subscription amount of US$200 million. When the transaction is completed, the target shares will account for 55.56% of the total issued shares of the target company after the expansion.

Will Nexperia's success be replicated again?

What is a lead frame? How important is it?

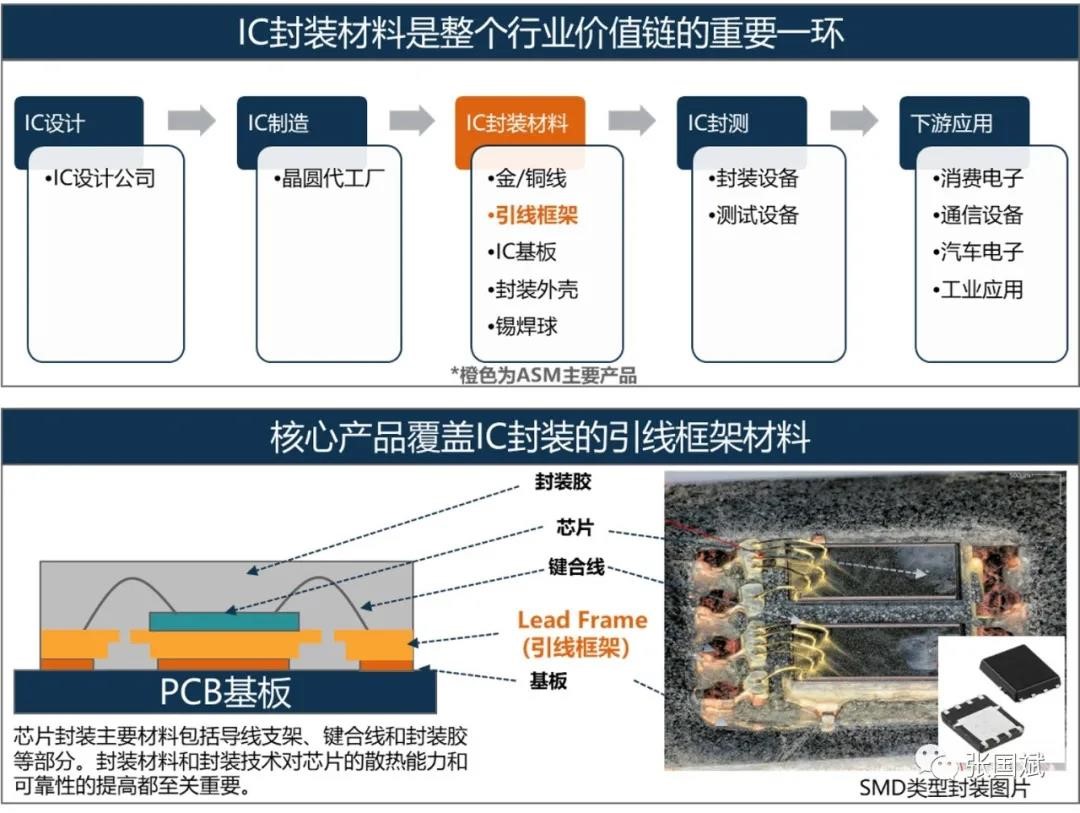

As we all know, an integrated circuit (IC) is composed of chips, leads and lead frames, adhesive materials, packaging materials, etc. Among them, the main function of the lead frame is to provide a mechanical support carrier for the chip, and as a conductive medium to connect to the external circuit of the IC, transmit electrical signals, and together with the packaging material, dissipate the heat generated when the chip is working, becoming the most critical part of the IC Components, many reliability performance of IC are determined by the performance of the package, the following figure demonstrates the application of the lead frame in packaging and testing.

Figure 2 The role of lead frame in integrated circuit packaging

The lead frame provides functions such as electrical pathways, heat dissipation pathways, and mechanical support for the chip (or die), which is directly related to the quality and yield of the IC. The lead frame is an important basic material in the electronic information industry.

Figure 3 The working principle of the lead frame

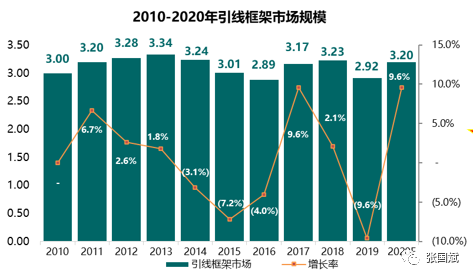

It is understood that the current global lead frame market has reached 3 billion US dollars, the market is stable, and there is no other material or technology that can completely replace the lead frame. ASM lead frames are mainly used in memory, analog IC (power devices), microcontrollers and automotive chips.

China is the world’s largest lead frame market. As the demand for integrated circuits increases, the lead frame market continues to grow. It is expected that the market size of China’s lead frame industry will continue to grow at a growth rate of 11.8% in the next five years. The market size will be in 2023. Will reach 26.19 billion yuan.

Figure 4 The lead frame market maintains steady growth

To build a complete local semiconductor industry chain, it is necessary not only to vigorously develop the integrated circuit design industry, but also to enrich and improve the technology in the field of semiconductor manufacturing and packaging and testing. Take the lead frame as an example. Although China has a large global lead frame market, the local The company is in a backward position in terms of technical strength and market share. In the lead frame market, Japanese manufacturers and Taiwanese manufacturers are in a leading position. Through cross-border mergers and acquisitions and cooperation, the local semiconductor industry can quickly make up for shortcomings and make use of local Market advantages will be bigger and stronger.

The lead frame business unit of the acquired ASM company ranks among the top three in the global lead frame field. It has advanced manufacturing technology and long-term product route planning. According to the electronic innovation network, the ASM lead frame business has been profitable for 20 consecutive years, with an average of the past 2 years. Annual revenue exceeds 250 million U.S. dollars.

ASM was established in Hong Kong in 1975 with annual sales revenue of 2 billion US dollars. It was listed in Hong Kong in 1989. The group is a global equipment manufacturer that provides technology and solutions for all process steps of semiconductor packaging and electronic product production, including semiconductor packaging From materials and back-end (chip integration, soldering, packaging) to SMT process, no other equipment supplier in the world has a similar comprehensive product portfolio and extensive knowledge and experience of assembly and SMT procedures. ASM has production plants in Singapore, Malaysia, China, and branches in Germany, Thailand, the Philippines, South Korea and other regions around the world.

In addition, ASM has high-quality customer relationships and has more than 15 years of cooperation history with major customers. Its customers include world-class IDM manufacturers such as Texas Instruments, STMicroelectronics, and Microchip, as well as a large number of semiconductor packaging and testing companies such as Jiangsu Changdian, Huatian Technology, Tongfu Microelectronics, etc.

The acquisition is of great strategic significance. The patented technology of the ASM Lead Frame Business Unit enables local companies to become the world leader in the field of lead frames, and make full use of ASM’s core technology and local scale advantages to seize the market share of companies in Japan and Taiwan. Further increase the market share in China and accumulate advantages in the field of semiconductor back-end packaging and testing.

I think this kind of win-win cooperation is similar to the acquisition of Nexperia in the past. After overseas technology and local capital are combined with the huge market, it will definitely burst out new momentum and promote the original business to a new level.

Judging from the ASM announcement, the two parties have spoken highly of this cooperation. Li Bin, Chairman of the Zhongguancun Financial Information Industry Alliance (FITA), said: “FITA is very pleased to form a strategic partnership with ASM and supports Zhilu Capital and ASM. Establish a joint venture company. Zhilu Capital is one of FITA's main investment platforms. Through FITA's alliance member network of more than 100 global high-tech companies, we are very confident that we can provide strong synergistic support to the joint venture and promote its rapid business growth ."

Mr. Huang Zida, CEO of ASM, emphasized, “The performance and financial strength of Zhilu Capital have created a strong foundation for our lead frame business and can stimulate the company’s internal development potential.”

Yang Fei, managing partner of Zhilu Capital, also said: “ASM is a world leader in the field of semiconductor packaging and testing. We have full confidence in its technology, quality and operational leadership. The senior management team of Zhilu Capital has brought good results to the joint venture. A combination of financial and industry expertise and related resources. We believe that such a combination will push the success of the joint venture to new heights."

Why can the acquisition be successful?

Wisdom Road Capital can successfully complete the acquisition of this high-quality asset thanks to its years of accumulation in the semiconductor field and an international background.

Zhilu Capital is one of the important members of the Rongxin Industry Alliance. It has continued to focus on the SMART field for many years, namely Semiconductor Value Chain, Mobile, Automotive Electronics, Robotics and Smart Manufacturing (Robots and Intelligent Manufacturing), IoT (Internet of Things), this is the investment concept advocated by Mr. Li Bin, chairman of the Financial Information Industry Alliance. He pointed out in the "Letter to Everyone" at the beginning of 2019: The SMART field is due to its basic supporting role In the future, it will have a decisive influence in the industrial upgrading of the entire national economy, and there will also be huge room for development in the future. With an international vision, Zhilu Capital insists on creating value for investors and partners, promotes international cooperation and technological exchanges through market-oriented operations, and deploys upstream and downstream of the industrial chain to help partners and investee companies grow healthily.

The acquisition of ASM's lead frame business by Zhilu Capital is also an important layout of the Rongxin Industry Alliance in the semiconductor industry chain. At the time of writing, the author has just heard that Zhilu Capital has acquired the Swiss Huba high-quality sensor business.

In the future, will Rongxin Industry Alliance have more major moves? Let's wait and see.