The average cost of the ASM laminator industry is affected by the scale effect and the learning effect. The more the cumulative output of the supply chain, the richer the production experience, the higher the production yield, the richer the production and management experience, and the higher the unit production cost of the product. Low; and as the supplier's production scale expands, and the fixed-cost investment in R&D and equipment is amortized on more products, the average cost of products can also continue to decline. For downstream manufacturers, procurement costs can also continue to drop.

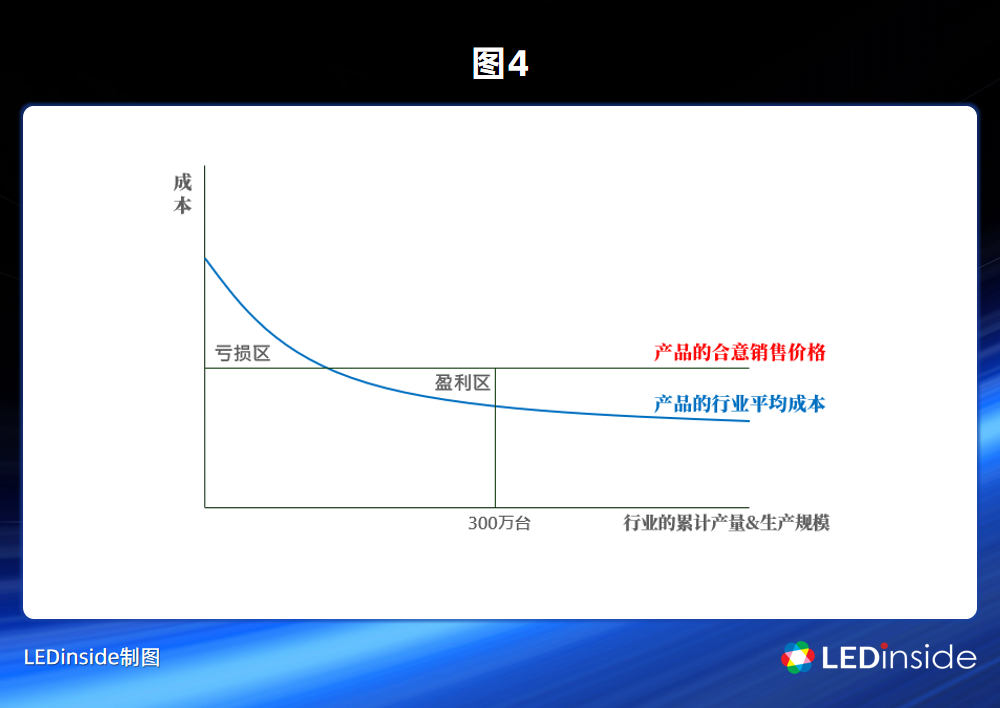

For each product, in terms of the consumer value it provides, it can actually be assumed that there is a desirable price level acceptable to potential consumers. Too high or too low a price is not an ideal situation. However, in the early stages of the industry, when the output of products was small, the phenomenon of inversion of costs and desirable sales prices was bound to occur. If a manufacturer chooses mass production at this time, it is undoubtedly helping the industry bear the high average cost and driving the industry average cost downward. Therefore, from the perspective of procurement, there are undoubtedly a large number of externalities.

Take a TV with MiniLED backlight as an example. The price should theoretically be positioned somewhere between ordinary LCD screens and OLED screens. However, from the perspective of early industrial costs, a large amount of concentrated R&D investment and specialized equipment and materials If the investment in limited production is amortized, the average cost will naturally remain high. Therefore, most of the existing transactions are sample transactions that are not included in the fixed cost amortization, and the scale is always limited to a few thousand units/month.

Therefore, despite several rumors in the market that Huawei will launch MiniLED-backlit TVs, they were all left alone in the end. The high average cost of a single machine will require Huawei to either set the price far higher than the desired price, or have Huawei to subsidize such a product to obtain the first-mover advantage it wants. Obviously, Huawei has given up this after weighing it. Kind of action plan to make wedding dresses for the industry.

The above analysis only analyzes the existence of externalities from the three dimensions of enterprise research and development, marketing and procurement. In fact, this kind of externality in the industry is far more than the points listed above. It can even be said that the externality of the industry is exactly Prerequisites for the existence of industrial clusters. Why companies like to get together is nothing more than the environment of industrial clusters. In such an environment, you may easily find skilled employees, reliable and experienced business partners, qualified suppliers that have undergone market testing, and even other clusters. Service items that may exist only when the degree of sub-engineering in the industry is extremely high.

But the existence of externalities also gives rise to the free-riding problem.

Take the current situation of the MiniLEDTV market as an example. Almost all the major domestic TV manufacturers have shown their own MiniLEDTV samples at the exhibition, but there are few that are actually sold in large quantities. The reason is that the major TV manufacturers are not Willing to be the leader and promote it alone in the early high-cost stage of the industry, but first show that you have such technologies and products, and give priority to establishing MiniLEDTV potential consumer groups' awareness of their own brand, but there is no real reality Mass production plans and actions.

On the other hand, several large TV manufacturers are equal in strength to each other, falling into the typical prisoner’s dilemma in the game [5], and following has become the optimal strategy. No one is willing to take the lead to break this balance, and the mass production dilemma of MiniLED is therefore form.

Since the mass production dilemma of MiniLED comes from the externality of the industry, the solution to the problem naturally comes from this. It is impossible to eliminate externalities, but it is possible to reduce free-riding behavior.

How to do it? Apple’s upcoming iPadPro and Macbook products with MiniLED backlight[6] and Samsung’s plan to launch 3 million TVs with MiniLED backlight[7] have broken the mass production dilemma that plagued the industry in one fell swoop. Obviously Provides a reference idea to reduce free-riding behavior.

1. Apple mode:

Apple is expected to launch the 12.9-inch MiniLED-backlit iPad Pro in the first quarter of 2021, and will also open a case for 14-inch and 16-inch MacBook products. From the observation of the supply chain [8], it is not difficult to find that the key supply chains are almost all Taiwanese manufacturers that have less contact with mainland manufacturers. The exception is Jingdian, which still has many customers in mainland China, but for this reason, it cut all the business from the mainland to Jingdian's factories in mainland China, and set up a firewall. Chip factories in Taiwan have to specialize in serving Apple's orders.

Confidentiality is certainly an important strategy for Apple, but the reason why Apple chooses the Taiwanese factory's supply chain is that the R&D and technical strength of the Taiwanese factory is certainly an important aspect. On the other hand, there is no terminal brand that threatens Apple in Taiwan. It is also an important factor.

In this way, even if Apple has borne the high initial cost and cultivated its supply chain, it does not have to worry too much about the free-riding behavior of competitors. Most of the externalities of the industry are eliminated within a closed Apple Taiwan-based industrial chain. In the long run, if externalities and free-riding concerns disappear and the weight of the average cost advantage rises, then the opportunity for mainland Chinese manufacturers to enter the Apple MiniLED supply chain will appear.

But this method is not easy to adopt, because it is not easy to find a relatively complete and closed supply chain, and even if there is, it is very unlikely to give up the entire forest for an apple.

2. Samsung mode:

In addition to Samsung's plans to launch TheWall high-end TVs in the European and American markets this year, it is expected to launch a variety of MiniLED backlight TVs of different sizes in 2021, the total number may be as high as 3 million units [9]. Why Samsung? And why is it 3 million units?

Why Samsung? Samsung is a company with a high degree of vertical integration in the TV industry. Therefore, its supply chain integration capabilities are superior to those of pure TV brands. Most of the problems of supply chain externalities can be solved within the group, and only some of them can not be solved internally. Only those links in the industrial chain with advantages need to rely on the market.

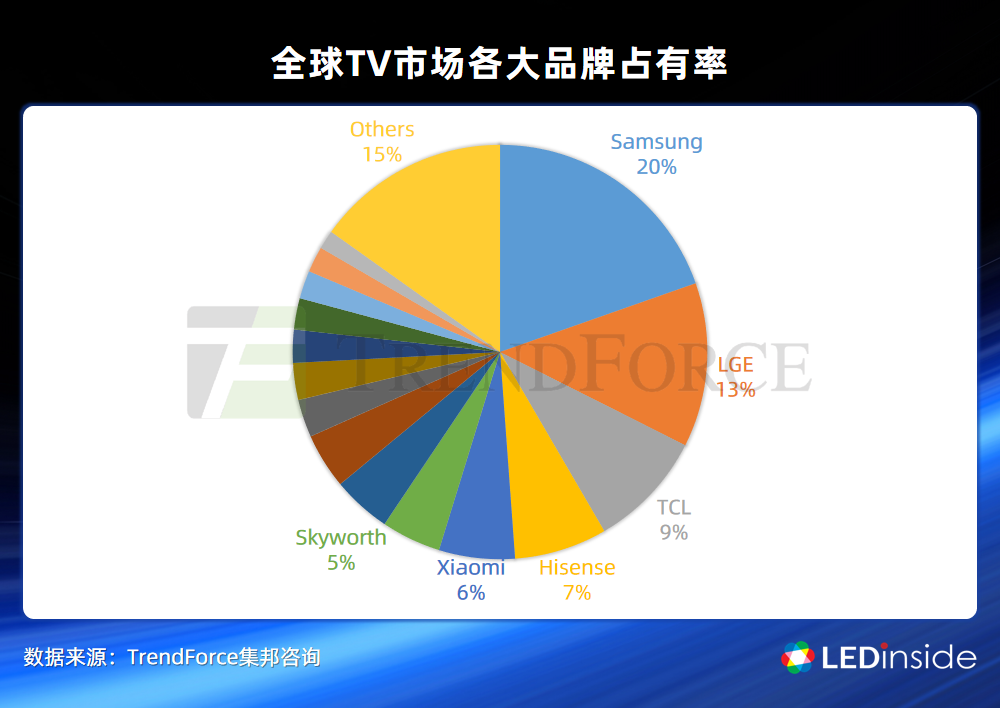

Regarding this part of the market, will it bring about the externality of procurement? Certainly, it is different from the balance of power of the four major domestic TV brands, TCL, Hisense, and Xiaomi Skyworth. In the global TV market, Samsung’s dominance alone, and therefore, the game structure has transformed from the prisoner’s dilemma in the domestic market to the wise pig game in the global TV market [10]. Samsung is the big pig. Even if you know that Piggy can hitchhiking, you still need to press the feed button to develop and create this market.

So why is it 3 million units? Isn't it 300,000 or 30 million?

Going back to the graph of the industry average cost curve we started at the beginning, if the product is priced at the right price, it means that the selling price of the previous products is lower than the average cost, but if we don’t care about this part The cost of the project is the same as looking at a project as a whole. Under a longer period or under a larger total scale, then the total cost/benefit status may be profitable.

Taking Samsung’s production plan of 3 million units as an example, it is very likely that the price level is in the first 1 million units and the average cost is higher than the selling price. The middle 1 million units are balanced, and only the next 1 million units can make money. However, as far as the overall project of 3 million units is concerned, it can be profitable.

Why not 300,000 units? Because the scale of 300,000 units is too small, it is very likely that it will not reach the goal of profitability for the entire product project cycle. Moreover, on the basis of 300,000 units, it is difficult to require suppliers to give a truly competitive price. On the basis of 3 million, each supplier will consider the average cost under this scale to make a quotation, so it is more likely to give A price close to the long-term average cost.

So why not 30 million units? That’s because Samsung TV’s annual global sales volume is about 40 million units, and less than one-tenth of the mid-to-high-end market is used to test a new product. The winning rate is high, but there is a risk that the market will not be as expected and lose completely. And the order of 3 million units is already very impressive for the current market, enough to move the market across the critical point of the virtuous circle of industry-scale explosion of cost reduction, so there is no need to take a larger proportion to risk.

Let's think again, how can domestic companies overcome the free-riding problem?

As far as the domestic market is concerned, TCL is closest to Samsung's situation. The vertical integration system of TCL's TV + Huaxing's panel determines that TCL's supply chain integration capabilities are stronger than other TV brands. However, it is difficult for TCL to request Huaxing’s MiniLED backlight screen to be used by his family alone, because this will inevitably push other TV brands to BOE. Therefore, it is difficult for TCL to have great motivation to cultivate the MiniLEDTV supply chain and allow other TVs. Manufacturers free ride.

In the absence of a vertically integrated company system, an ideal alternative is strategic alliances. Among the alliance enterprises, the leader enterprise plays a leading role in the industrial chain, and determines the distribution of benefits among the alliance enterprises through the control of prices and shares. Companies that have contributed a lot to the alliance will receive more support in terms of price and share, and will punish opportunistic ones, those who just want to free-rider and are unwilling to pay, and betray the alliance.

As far as the MiniLED backlight industry chain is concerned, it seems that BOE and Huaxing are the two major panel factories that are most suitable for this role, because panels are the key link between upstream and downstream, and this link is highly concentrated and is the easiest part of the industry chain. Dominant force. Formally, it can be that two organizations and one alliance advance and retreat together, or they can form an alliance to compete fairly. Which alliance's boss is more responsible, and which system benefits distribution is more fair and reasonable, and which alliance wins. Regardless of the form, the goal is to overcome the problem of free-riding and to promote the industry to overcome the obstacles in the early stage and enter the virtuous track of industrialization.

As Apple and Samsung have begun to enter the mass production process, no matter how they guard against externalities, the industry chain will definitely benefit. For most related companies, it is now time to actively embrace the industry trend driven by leading companies and enjoy the bright moment of industrial scale expansion, industrial value increase, and industrial dividend spillover. (Author: Wang Fei, principal analyst LEDinside)